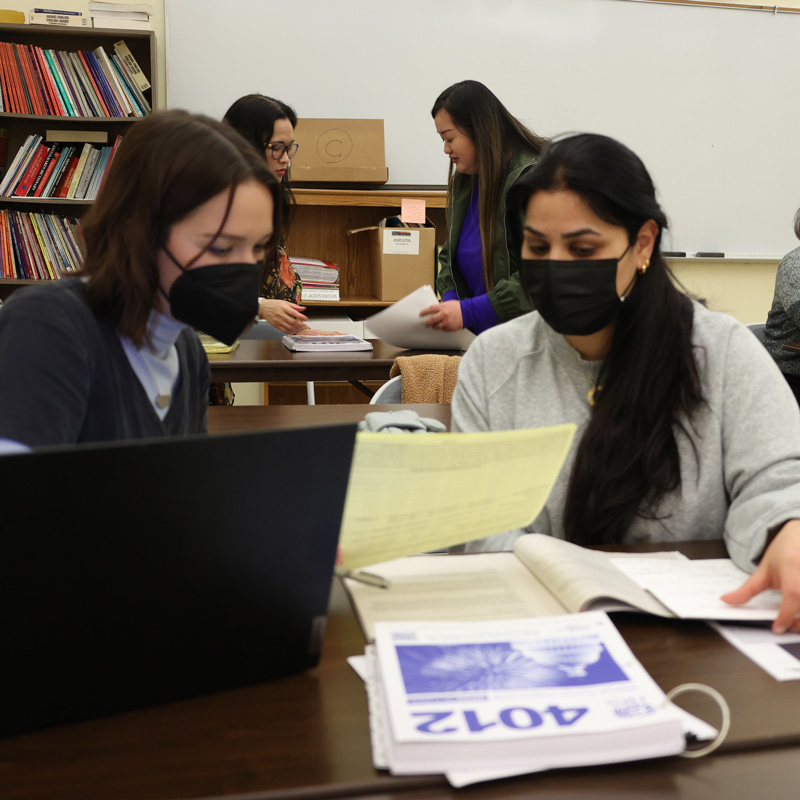

IRCO Free Tax Clinics

IRCO offers free tax processing services to community members earning less than $100,000 annually in their household. Through our IRS-Certified Volunteer team, you'll receive tax assistance with IRCO's standard of high-quality, culturally specific service.

Clinics run throughout the year; restrictions apply.

Volunteer with our Tax Team

As an IRCO-trained tax processing assistant, you'll make a meaningful impact as you guide community members to a sound financial future.